The United States House of Representatives passed legislation on January 22, 2026, significantly strengthening enforcement mechanisms and oversight of advanced AI chip and technology exports, particularly those destined for China and other nations deemed adversarial to U.S. interests. The bipartisan bill reflects growing Congressional concern that existing export controls, while extensive on paper, suffer from enforcement gaps that allow prohibited technology to reach restricted end-users through indirect channels and intermediary countries.

The legislation builds upon export control frameworks established by the Commerce Department’s Bureau of Industry and Security, which has imposed progressively tighter restrictions on semiconductor exports since 2022. Previous regulations limited sales of Nvidia’s most advanced GPUs (including the H100 and A100 chips) to China and restricted American companies from supporting Chinese semiconductor manufacturing capabilities. However, enforcement has proven challenging given the complexity of global supply chains and the fungibility of technology products.

The new legislative framework introduces several enforcement enhancements designed to close loopholes that have undermined existing controls. First, it mandates stricter end-user verification requirements, forcing exporters to conduct more thorough due diligence on ultimate recipients and use cases for advanced chips. Companies selling AI accelerators, high-bandwidth memory, and related technologies must now document entire supply chains and certify that products will not be diverted to restricted entities or applications.

Second, the legislation strengthens penalties for violations, increasing both criminal and civil sanctions for individuals and companies that circumvent export controls. Previous enforcement actions resulted in relatively modest fines that critics argued were insufficient to deter violations given the enormous profits available in AI chip markets. The new penalty structure creates meaningful financial and reputational risks for non-compliance.

Third, the bill enhances coordination between the Commerce Department, State Department, Treasury Department, and intelligence agencies to improve detection of evasion schemes. Export control enforcement traditionally suffered from siloed information and limited intelligence sharing. The new framework requires regular inter-agency meetings, shared databases of suspicious transactions, and coordinated investigations of potential violations.

Fourth, the legislation addresses third-country transshipment by requiring verification that countries receiving unrestricted chip exports maintain adequate controls preventing re-export to China or other restricted destinations. Singapore, Malaysia, and several other Southeast Asian nations have emerged as potential transshipment hubs where chips ostensibly purchased for legitimate local use are instead redirected to Chinese customers. The new rules increase scrutiny of exports to these intermediate markets.

The political dynamics surrounding the legislation reflect unusual bipartisan consensus on the strategic importance of maintaining U.S. technological advantages in artificial intelligence. Both Republican and Democratic lawmakers expressed concern that China’s progress in AI poses national security risks, potentially enabling advances in autonomous weapons systems, surveillance technologies, and other military applications. Export controls represent one of the few policy tools available to slow adversarial AI development without directly restricting American innovation.

Representative statements during floor debate emphasized the military and surveillance implications of AI technology. Lawmakers cited concerns about AI-powered weapons systems, facial recognition surveillance, and autonomous military platforms that China is actively developing. Preventing access to the most advanced AI training chips, proponents argued, creates computational bottlenecks that constrain the sophistication and scale of AI systems China can deploy for military and intelligence purposes.

Critics of tighter export controls, including some technology industry representatives, argued that restrictions may prove counterproductive by accelerating Chinese development of domestic alternatives. When denied access to Nvidia chips, Chinese companies have intensified investments in homegrown semiconductors, making progress despite technological challenges. Some industry analysts warn that export controls provide short-term advantages but risk losing long-term market share to competitors not subject to U.S. restrictions.

The legislation’s passage follows reports of evolving Chinese procurement strategies to circumvent existing controls. Investigation by technology publications revealed sophisticated networks where Chinese AI labs purchase chips through shell companies registered in unrestricted jurisdictions, utilizing cryptocurrency payments and circuitous shipping routes to obscure ultimate recipients. Others lease cloud computing capacity from providers operating outside U.S. jurisdiction, accessing prohibited chips remotely without physically importing hardware.

Payment verification represents another enforcement challenge addressed in the new legislation. Some Chinese entities reportedly faced stricter payment terms from chip sellers requiring cash upfront or restricted financing rather than standard commercial credit arrangements—a subtle indicator of export control uncertainty. The legislation clarifies that financial institutions facilitating transactions involving controlled technologies face potential liability, creating incentives for banks to conduct their own compliance reviews.

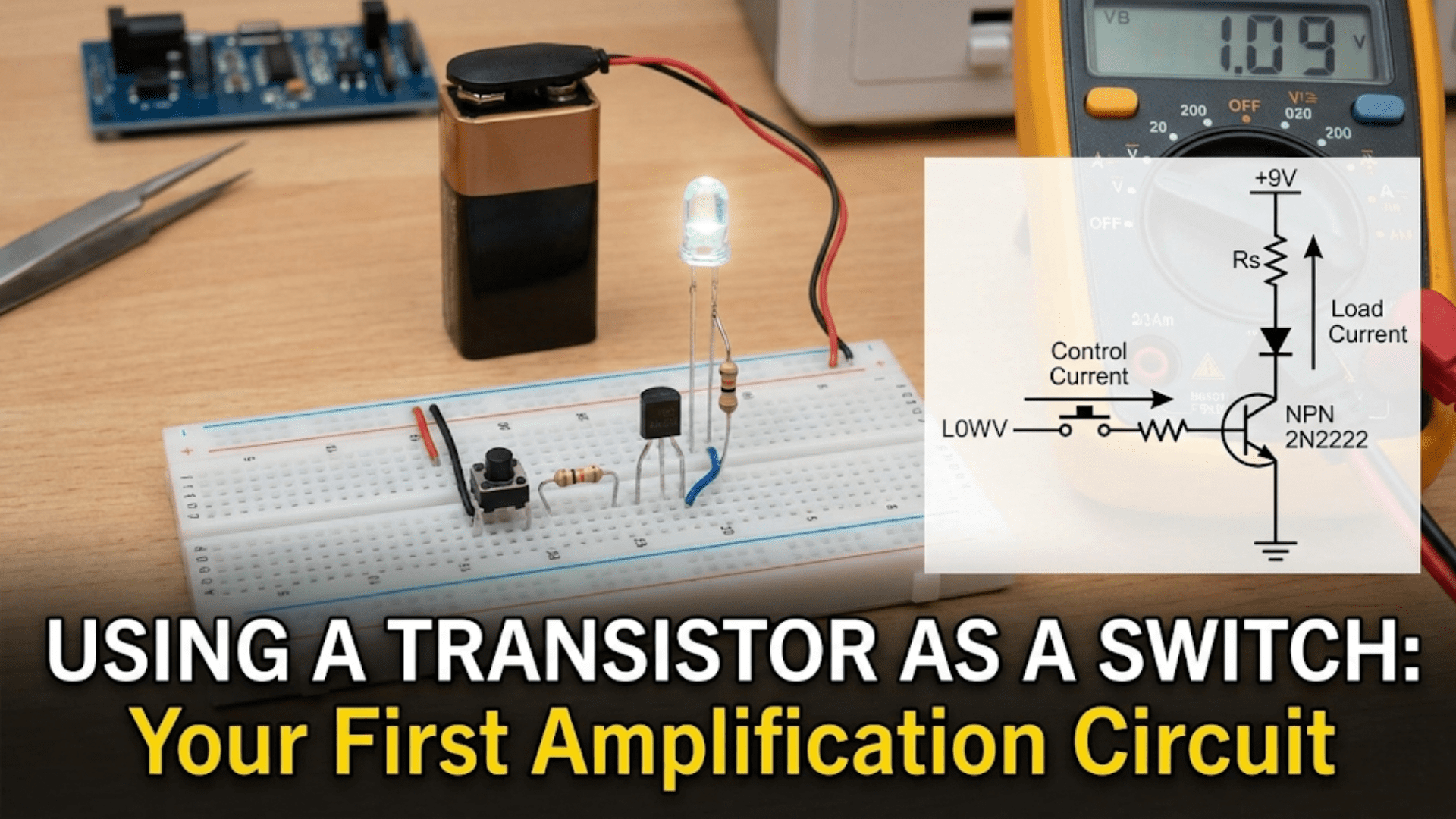

The global semiconductor supply chain’s complexity creates inherent enforcement difficulties. Advanced chips like Nvidia’s H100 contain components from multiple countries, undergo manufacturing steps across several nations, and move through distribution networks spanning continents. Tracking individual chips from fabrication through end-use requires unprecedented supply chain visibility that has historically been impossible to achieve. Blockchain-based tracking technologies and other innovative approaches may be necessary to meet the new verification requirements.

U.S. allies present particularly sensitive enforcement challenges. European countries, Japan, South Korea, and Taiwan all produce or sell semiconductor manufacturing equipment and chips that could potentially reach China. While these nations generally align with American strategic objectives, they also maintain independent commercial relationships with China and may resist implementing controls as restrictive as U.S. regulations. The legislation encourages diplomatic engagement to harmonize allied export controls, though binding international agreements remain elusive.

The effectiveness of export controls ultimately depends on the gap between controlled and unrestricted capabilities. If only the very latest generation chips face restrictions while previous generations remain available, Chinese AI development may continue using slightly older but still-capable hardware. The Commerce Department periodically updates the “red line” defining which chip specifications trigger controls, attempting to maintain a meaningful technology gap. However, this creates a moving target where controls must continuously tighten to maintain effectiveness.

Chinese responses to strengthened export controls are likely to include several strategies. First, accelerated investment in domestic semiconductor capabilities across the entire value chain from manufacturing equipment to chip design. Second, partnerships with non-U.S.-aligned countries to develop alternative supply chains bypassing American chokepoints. Third, continued emphasis on algorithmic efficiency and software optimization to extract maximum performance from available hardware. Fourth, potential retaliation through export restrictions on materials critical to Western supply chains.

For American semiconductor companies, stricter export controls create mixed effects. On one hand, they protect competitive advantages by limiting technology diffusion to strategic competitors. On the other hand, they exclude companies from the large and growing Chinese market, potentially ceding market share to competitors not subject to U.S. jurisdiction. Nvidia, for instance, derived significant revenue from Chinese customers before controls tightened, and now faces permanent loss of some of this business.

The legislation’s impact on global AI development patterns could be substantial. If successful, export controls might bifurcate the AI ecosystem into distinct U.S.-aligned and China-aligned spheres, each with different hardware, software standards, and capabilities. This fragmentation could reduce knowledge sharing and slow overall progress while potentially creating redundant development efforts. Alternatively, controls might prove insufficiently effective to prevent Chinese progress, merely irritating allies and partners without achieving strategic objectives.

Looking ahead, enforcement infrastructure must be built to implement the new legislative requirements. This includes hiring additional compliance officers, developing systems to analyze transaction data for suspicious patterns, conducting international outreach to partner countries, and potentially creating new investigative units within relevant agencies. The budgetary costs of effective enforcement are substantial, though likely small compared to the strategic stakes involved.

The long-term success of AI chip export controls will depend on maintaining technological leadership that justifies the economic costs and diplomatic friction they create. If American semiconductor and AI industries continue innovating rapidly, export controls help preserve advantages by slowing adversary progress. If innovation slows or Chinese alternatives close capability gaps, export controls become less effective while relationship costs persist. The legislation passed on January 22, 2026, represents a bet that maintaining AI leadership requires actively managing technology diffusion, accepting short-term market access sacrifices to preserve long-term strategic advantages.