Jimmy Donaldson, known globally as MrBeast and the creator of the world’s most subscribed YouTube channel, announced on February 10, 2026, the acquisition of Step, a youth-focused financial services application offering debit cards, savings accounts, and financial education tools designed specifically for teenagers. The acquisition merges one of the most powerful youth media brands in history with a fintech platform built for exactly the demographic that considers MrBeast content a defining cultural touchstone.

Step was founded in 2018 and has grown to millions of registered users by offering FDIC-insured spending accounts with Visa debit cards, a companion app featuring spending analytics and savings goal tools, peer-to-peer money transfers enabling teens to send money to friends, and credit-building features allowing parents to extend supervised credit to minors. The platform’s design emphasises financial literacy — framing accounts as education tools that help teenagers understand budgeting, saving, and responsible spending before transitioning to traditional adult banking products.

MrBeast’s acquisition rationale extends well beyond the financial services market. With over 250 million YouTube subscribers across his main channel, reaction channel, gaming channel, and Spanish-language channel, Donaldson reaches more teenagers than any traditional advertising campaign could approach. The ability to cross-promote Step directly to this audience through organic integration in content — where MrBeast financial challenges, giveaway mechanics, and charitable giving narratives align naturally with money management themes — creates customer acquisition economics no conventional fintech marketing budget could replicate.

The acquisition fits a broader pattern of MrBeast expanding from content creation into consumer businesses. His MrBeast Burger virtual restaurant franchise, Feastables chocolate brand, and MrBeast Coffee have demonstrated that his audience converts at unusually high rates to physical products when he introduces them authentically within content contexts. Financial services represent a higher lifetime value category than food brands, with potential for long-term customer relationships as teenage users age into adult financial products.

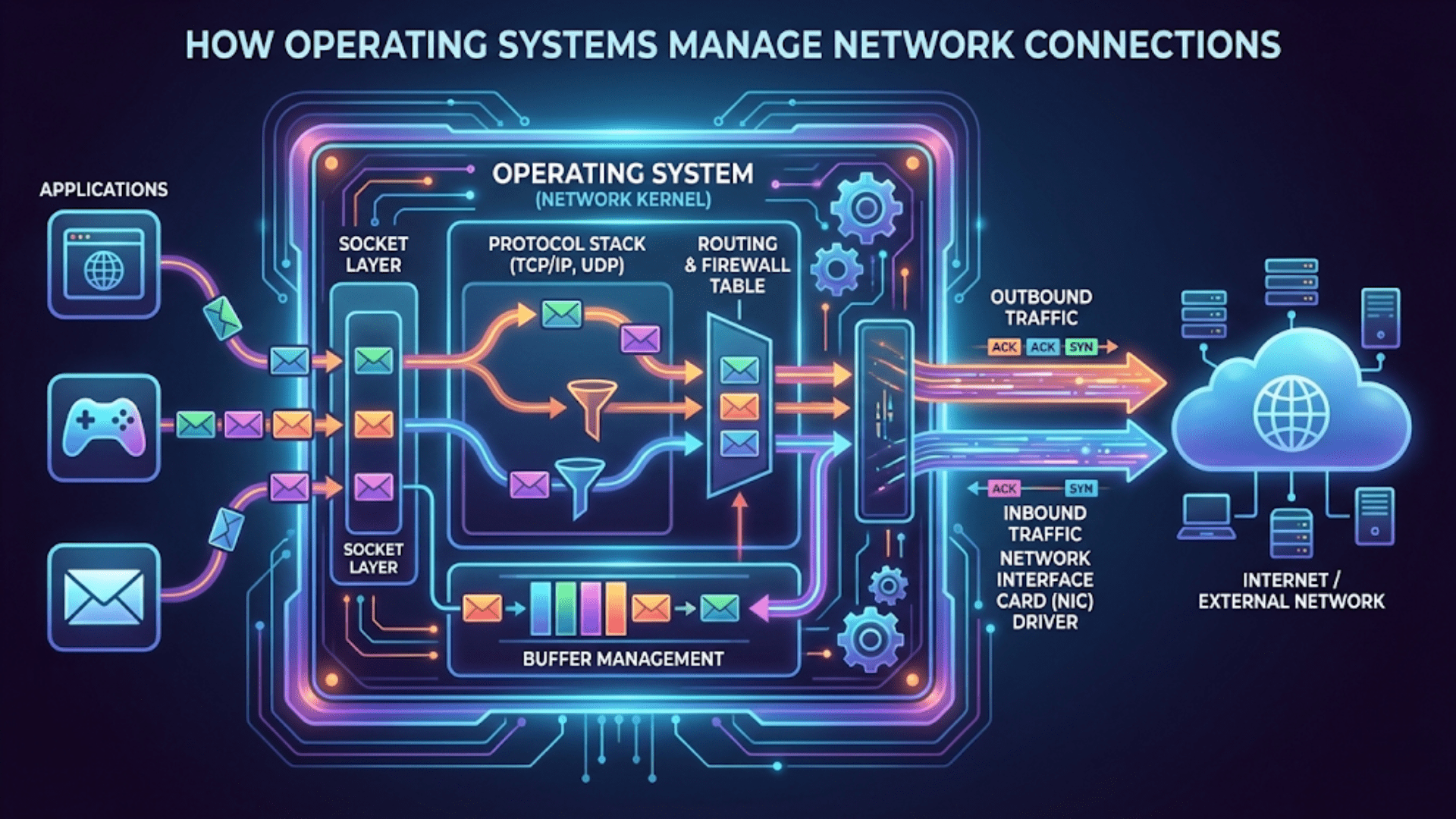

Regulatory implications are significant. Banking and financial services are among the most regulated industries, with specific rules governing accounts for minors including parental consent requirements, advertising restrictions, and fiduciary obligations. Step’s existing compliance infrastructure, banking partner relationships, and regulatory approvals provide MrBeast with a ready-made framework rather than requiring years of regulatory navigation to build a new financial product from scratch.

Competition in teen banking is intensifying. Greenlight, Current, and Till Financial all target similar demographics with comparable product sets. Traditional banks including Chase and Bank of America have launched youth-focused products. But none of these competitors possesses anything resembling MrBeast’s distribution capability, which may prove the decisive advantage in a market where customer acquisition cost is the primary barrier to scale.

Financial terms of the acquisition were not disclosed. Industry observers estimate Step was valued in the range of $500 million to $1 billion based on comparable fintech valuations.