Chata Technologies, a Canadian AI startup focused on the financial services sector, announced on January 23, 2026, that it has closed a $10 million USD Series A funding round to scale what the company describes as “deterministic AI” for enterprise financial applications. The funding round reflects growing recognition that regulated industries require artificial intelligence systems with fundamentally different characteristics than the general-purpose large language models dominating consumer AI—specifically prioritizing predictability, auditability, and compliance over flexibility and creativity.

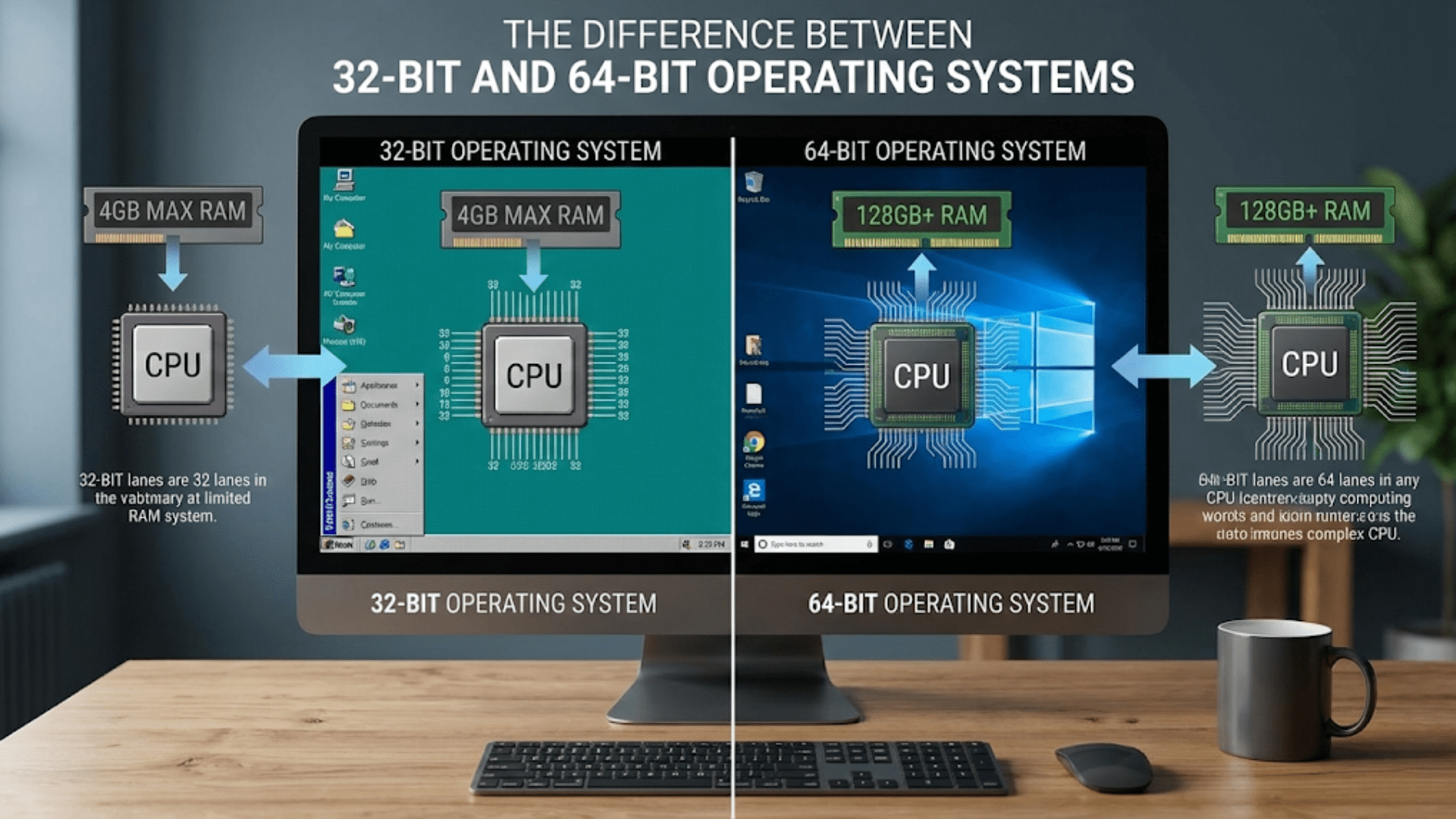

The concept of deterministic AI addresses a core tension in enterprise AI adoption, particularly in regulated sectors like financial services, healthcare, and government. Standard large language models are inherently probabilistic—they generate outputs based on patterns learned from training data but without guarantees about consistency, accuracy, or reasoning transparency. Ask the same question multiple times and you might receive different answers. This non-determinism creates challenges for industries where consistency, accountability, and regulatory compliance are paramount.

Financial institutions face particularly stringent requirements around explainability and auditability. Regulators demand that institutions document and justify decisions affecting customers, especially in areas like lending, trading, and compliance. If an AI system denies a loan application or flags a transaction as suspicious, the institution must be able to explain why—not just “the AI said so” but with clear reasoning traceable to specific inputs and rules. Probabilistic AI systems struggle to provide such explanations in forms satisfying regulatory requirements.

Chata’s approach involves designing AI systems with constrained outputs and explicit reasoning chains. Rather than allowing models to generate free-form responses that might vary across runs, Chata’s systems follow defined logic pathways and produce outputs from predetermined acceptable ranges. This sacrifices some of the creativity and flexibility that makes consumer AI impressive but gains the reliability and consistency that enterprises need for operational processes.

The target use cases for deterministic AI in finance span numerous applications. Automated compliance monitoring systems must reliably detect regulatory violations without missing true positives or generating excessive false alarms. Risk assessment models need to produce consistent scores for similar situations to avoid arbitrary treatment of customers. Financial reporting automation requires perfect accuracy and audit trails showing exactly how figures were calculated. Trade surveillance systems must identify suspicious patterns without flagging legitimate activity at rates rendering them unusable.

Traditional financial institutions have used rule-based systems for such applications for decades, but these systems require extensive manual programming and struggle to adapt to changing circumstances. Pure AI approaches offer adaptability but lack the guarantees financial institutions require. Chata’s deterministic AI attempts to bridge this gap—more flexible than rigid rules but more controlled than unconstrained AI.

The Series A funding will enable Chata to expand beyond early adopter customers to broader market deployment. The company plans to invest in sales and marketing to reach additional financial institutions, enhance its product platform to cover more use cases, and build out implementation and support teams to handle enterprise deployments. Financial services sales cycles are notoriously long, with risk-averse institutions conducting extensive evaluations before adopting new technologies, particularly those touching core operations.

The competitive landscape includes both traditional financial technology vendors enhancing existing products with AI and pure-play AI companies adding compliance features. Established players like FIS, Fiserv, and Jack Henry have decades of customer relationships and deep integration with banks’ core systems. Pure AI companies like those developing large language models for enterprises (Anthropic, OpenAI’s enterprise offerings, Cohere) are adding features addressing financial services concerns but may lack the domain expertise and regulatory understanding specialized vendors possess.

Chata’s positioning emphasizes its focus on financial services specifically rather than attempting to serve all industries with general-purpose tools. This specialization enables deeper understanding of regulatory requirements, common workflows, data formats, and integration needs specific to banking, insurance, asset management, and related sectors. The company can optimize for use cases mattering most to financial institutions rather than building broadly applicable but potentially inadequate capabilities.

The $10 million Series A, while substantial for an early-stage enterprise software company, is modest compared to the billions being raised by foundational AI model developers. This reflects different business models: Chata is building applications and solutions using AI as a component rather than training massive models from scratch. The capital requirements are correspondingly lower, focused on product development, customer acquisition, and operational infrastructure rather than GPU clusters and petabytes of training data.

Investors backing Chata reportedly include financial technology-focused venture firms and strategic investors with financial services industry connections. Such investors provide not just capital but also domain expertise, customer introductions, and credibility with risk-averse institutions evaluating new technologies. In enterprise software, particularly for regulated industries, these non-capital contributions often matter as much as the funding itself.

The regulatory environment for AI in financial services continues evolving. Regulators globally are developing frameworks for algorithmic accountability, automated decision-making, and AI risk management. The European Union’s AI Act, various U.S. agency guidelines, and similar initiatives in Asia all create compliance obligations for financial institutions using AI. Systems designed from the ground up for these requirements have advantages over general-purpose tools requiring extensive modification to meet regulatory standards.

Explainability represents a particularly challenging requirement. Regulators increasingly demand that institutions using AI in customer-impacting decisions provide clear explanations of how those decisions were reached. “The model predicted X with Y confidence” often proves insufficient—regulators want to understand which specific factors influenced the decision and by how much. Deterministic systems with explicit reasoning chains can provide such explanations more readily than opaque neural networks.

The financial services industry’s conservative approach to technology adoption means that even successful vendors face long timelines between product development and significant revenue. Banks conduct extensive pilots, require reference customers, demand security audits, negotiate contracts through legal reviews lasting months, and test integrations before production deployment. This sales cycle reality makes early-stage funding crucial for sustaining operations during the period before recurring revenue reaches sustainable levels.

Chata’s success will ultimately depend on demonstrating that deterministic AI delivers superior business outcomes—measured in accuracy, reliability, cost savings, or risk reduction—compared to both traditional rule-based systems and alternative AI approaches. Financial institutions make technology decisions based on rigorous evaluation of whether solutions actually work reliably at scale in production environments, not just demonstrations or proofs of concept.

The broader enterprise AI market increasingly recognizes the distinction between capabilities needed for consumer applications versus regulated enterprise use cases. Consumer AI can tolerate occasional errors, inconsistency, and opacity because individual interactions have low stakes. Enterprise AI, especially in finance, healthcare, and other regulated domains, requires reliability standards more akin to traditional enterprise software. This realization is driving development of specialized AI approaches tailored to enterprise requirements.

Looking ahead, Chata Technologies faces both opportunities and challenges scaling its deterministic AI vision. The market opportunity is substantial if financial institutions broadly adopt AI for operational processes beyond experimental use cases. The challenge lies in proving superiority over both established vendors adding AI features and well-funded AI companies targeting enterprises. The $10 million Series A provides runway to pursue customer acquisition, product development, and market education necessary to establish the company in a competitive and rapidly evolving market.